Electric vehicles are no longer an emerging trend-they are a structural force reshaping global mobility, energy systems, and industrial policy. In 2025, electric vehicles accounted for more than 25% of new vehicle sales globally, with China surpassing the 50% mark and Europe recording months where EVs outsold internal combustion vehicles entirely.

As adoption accelerates, batteries have become the true strategic battleground. In 2026, the EV battery landscape will be defined by three forces: new chemistries entering commercial use, heightened geopolitical realignment, and relentless pressure on cost and performance.

For executives across automotive, energy, manufacturing, and infrastructure, battery strategy is now business strategy.

Sodium-Ion Batteries: Cost Takes Centre Stage

Lithium-ion batteries remain the dominant chemistry powering EVs worldwide. However, shifting market conditions-particularly in cost-sensitive regions-are opening the door for alternatives.

Sodium-ion batteries are emerging as a credible low-cost option, especially for short-range vehicles and mobility segments where maximum energy density is not essential. Sodium is significantly more abundant than lithium, offering long-term supply stability and insulation from commodity price volatility.

While sodium-ion batteries currently deliver lower range, their cost advantage is narrowing the gap. Average sodium-ion battery costs now stand near $59 per kilowatt-hour, compared with $52 per kilowatt-hour for lithium iron phosphate (LFP)-a difference that could quickly reverse as lithium prices rise.

China is leading commercialization. Companies including CATL, HiNa Battery, Yadea, and JMEV are already deploying sodium-ion batteries in electric scooters, compact EVs, and pilot vehicle programs. CATL has confirmed plans to launch its first sodium-ion–powered EV in 2026.

For global automakers, sodium-ion batteries represent a strategic lever for cost containment, particularly in emerging markets and urban mobility fleets.

Solid-State Batteries: 2026 Becomes the Year of Proof

Solid-state batteries have long been positioned as the industry’s “next big leap,” promising:

- Higher energy density

- Improved safety

- Longer vehicle range

Yet execution-not ambition-has been the challenge.

As the industry enters the second half of the decade, 2026 marks a turning point where solid-state claims face real-world validation. Manufacturers are moving beyond lab-scale demonstrations toward automotive testing and early commercialization.

Notable milestones include:

- Factorial Energy, whose solid-state cells powered a Mercedes test vehicle over 745 miles on a single charge

- Toyota, targeting limited solid-state deployment by 2027–2028

- QuantumScape, advancing toward pilot-scale automotive production later this decade

Before full solid-state adoption, semi-solid-state batteries-which reduce but do not fully eliminate liquid electrolytes-are expected to bridge the gap. Many Chinese manufacturers are pursuing this staged approach, accelerating time-to-market while de-risking manufacturing scale-up.

For executives, the takeaway is clear: solid-state batteries are no longer speculative, but they remain capital-intensive and execution-sensitive.

Battery Geopolitics: A Fragmented Global Map

The EV battery industry in 2026 looks vastly different depending on geography.

China continues to dominate, producing more than one-third of all EV batteries globally and controlling much of the upstream supply chain. Its influence is expanding internationally, with new manufacturing hubs in Europe and improving access to markets such as Canada.

Meanwhile:

- Europe is accelerating localization through regulatory mandates and strategic partnerships

- Emerging markets including Brazil, Thailand, and Vietnam are rapidly scaling EV adoption and local production

- The United States faces headwinds following the expiration of federal EV tax credits, slowing near-term vehicle adoption

However, the U.S. is finding momentum in stationary energy storage, with large-scale LFP battery factories coming online in Michigan and Georgia-positioning batteries as a grid and energy asset even amid slower EV sales.

The result is a patchwork global battery economy, where supply chains, incentives, and technology adoption vary sharply by region.

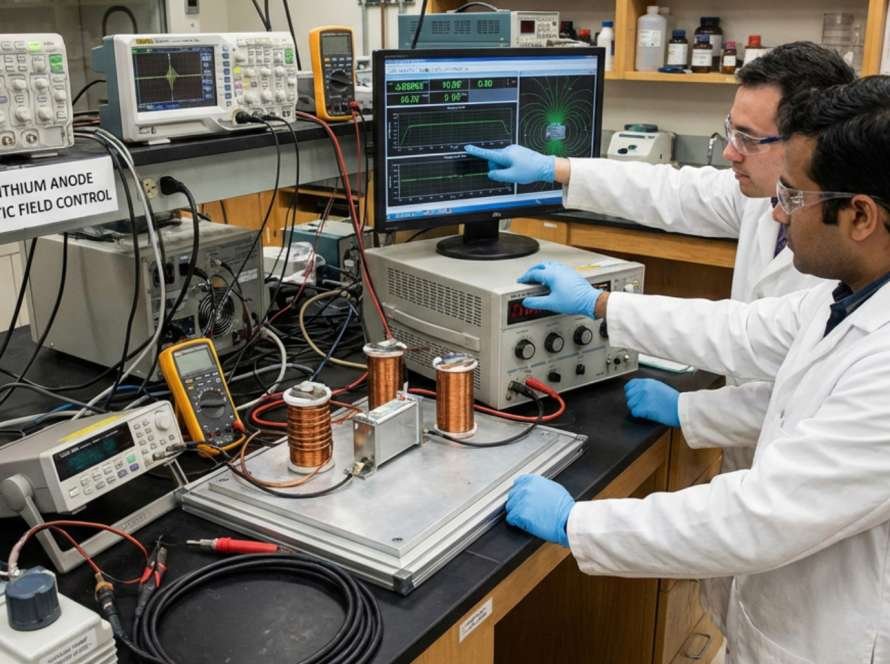

Read more about how: Magnetic Fields Unlock a New Generation of Safer Lithium Batteries

Executive Outlook: Batteries Become the Competitive Differentiator

By 2030, an estimated 40% of new vehicles sold globally will be electric. As that milestone approaches, battery strategy will increasingly determine:

- Vehicle affordability

- Market access

- Supply chain resilience

- Long-term profitability

In 2026, expect:

- A broader mix of battery chemistries on the road

- Intensifying competition between vertically integrated and modular battery models

- Policy decisions that materially reshape regional winners and losers

The companies that succeed will not be those chasing a single breakthrough-but those building flexible, multi-chemistry, globally resilient battery strategies.